If you work in Web3 and complain about central bank money printing, you must read this article. Why did society create the first central bank?

In the late 17th century, Sweden took a bold step in the world of finance by creating Sveriges Riksbank, the first central bank. Europe went from private banks like the Medici Bank in Italy to a new era of government-controlled finance.

Currency Control Before Central Banking

In 1619, the landscape of Swedish finance was markedly different from today's banking systems. Private banking in Sweden, much like in the rest of Europe, was in its developing stages. These private banks were typically small-scale operations, often run by individual merchants or families. Their services were primarily focused on facilitating trade, extending credit to merchants, and handling deposits. Each city had a bank which formed a decentralized network of independent banks.

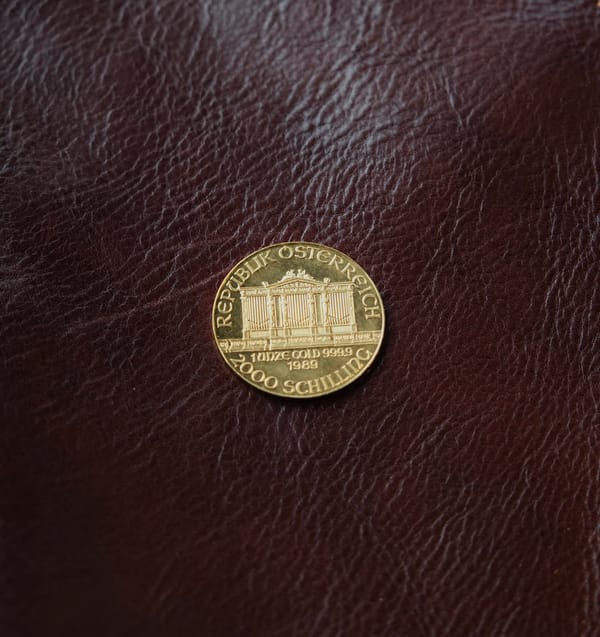

Unfortunately, the Swedish Empire faced financial challenges due to prolonged military engagements, such as the Thirty Years' War. As in Athens (1st article) and later in Rome (2nd article), the government started minting more new coins to cover the cost of war and other government spending by minting new copper coins but of lower weight and thus lower metal value, devaluing its currency.

The Advent of Banknotes

It's now the second advent Sunday, and I couldn't resist but to use "advent" in the title. Merry, soon, Christmas!

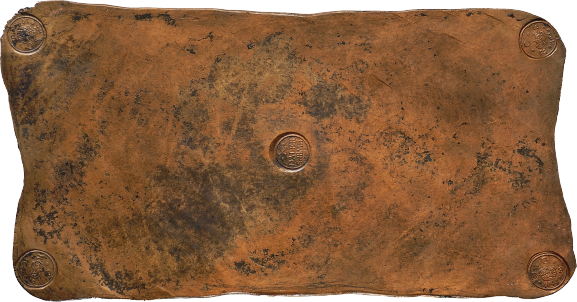

But, exchanging copper coins, especially the large ones, was a cumbersome activity. Johan Palmstruch had an idea to create a new form of money, made of paper, which would act as deposit certificates, giving the owner the right to withdraw the deposited amount in copper coins - should they wish. This marked a significant departure from the heavy and clunky copper coins, making the banknotes popular for their convenience.

For example, the biggest copper coin weighted 19.7 kg and is the largest coin in the world.

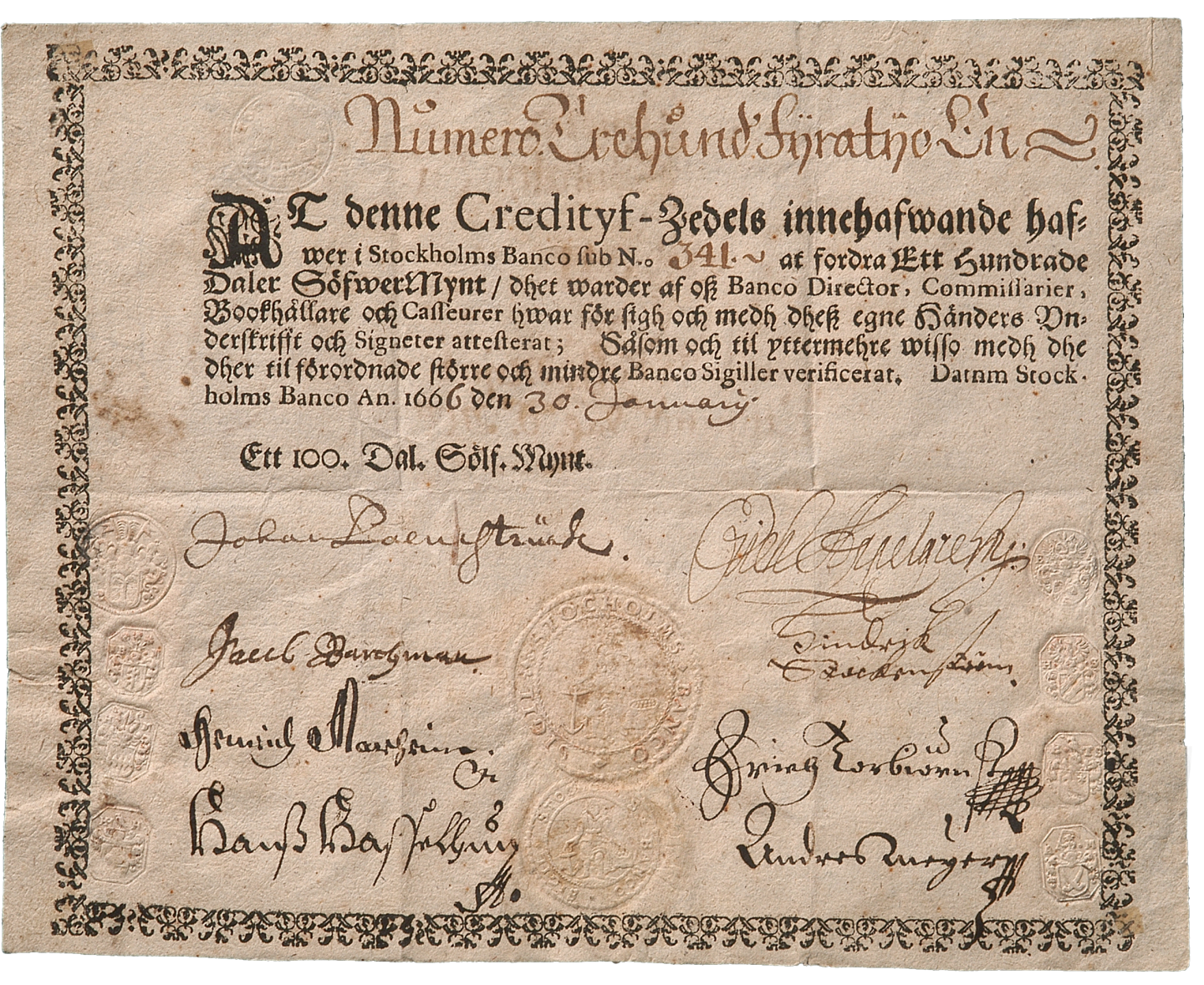

Palmstruch had made two failed proposals to create a banking institution. Only his third proposal got accepted by the crown - probably because he promised to pay half of the bank's profits to the crown... and so Palmstruch was allowed to issue the first banknotes in Europe in 1661.

The banknotes, or credit notes, were also revolutionary because they were not linked to any specific deposit!!! Instead, they were based on public confidence that the bank would redeem the note's value in coins upon demand.

However, the issuance of these banknotes led to challenges. As Stockholms Banco printed more notes, their value fell, leading to inflation. Eventually, confidence in the banknotes waned, and the public demanded redemption in coins, which the bank could not fulfill. The government intervened in 1664 to repay the loans and withdraw the credit notes, marking the beginning of a more regulated approach to currency management. This government intervention in private banking set the stage for the establishment of Sveriges Riksbank and the evolution of modern central banking practices. Palmstruch was sentenced to death for his bank's mismanagement.

The Creation of Sveriges Riksbank

On September 17, 1668, the Swedish Parliament took a decisive step and transferred the Stockholms Banco into a state-run entity to stabilize its currency and consolidate control over the nation's money supply.

This new bank, Sveriges Riksbank, did not issue banknotes again until the 18th century and remains a central bank of Sweden to this day.

Stabilizing the currency

Further, the Swedish parliament introduced several key innovations:

- Centralization of Monetary Policy: allowed for more coordinated and effective currency management.

- Regulation of Money Supply: having a centralized institution specifically tasked with overseeing the money supply, Sweden could better manage inflation and the value of the Riksdaler.

- Lender of Last Resort: the central bank also acted as a lender of last resort, providing a safety net for other banks and financial institutions. This role was essential in preventing bank runs and maintaining confidence in the financial system.

- Facilitating Government Finance: The bank played a key role in managing the government's finances, particularly in terms of handling national debt.

Practical explanation of the Central Bank's role

Effectively managing the money supply is a critical aspect of controlling inflation. The central bank's role in this process involves a delicate balance: stimulating the economy when necessary without triggering excessive inflation.

Example of Stimulating the Economy Without Causing Inflation:

- Economic Downturn Scenario: Imagine an economic downturn where businesses struggle and unemployment is high. In such a scenario, a central bank might decide to increase the money supply.

- Action Taken: The bank does this by lowering interest rates or buying government bonds, effectively putting more money into circulation.

- Result: This increased money supply can encourage spending and investment. Businesses might take loans to expand, and consumers might spend more, both of which can help revive the economy.

- Inflation Control: If done correctly, and especially if the economy is underperforming, this increase in money supply doesn't necessarily lead to inflation. That's because the extra money is used to utilize idle resources, like unemployed workers or unused factory capacity, rather than just increasing prices.

Example of Excessive Money Printing Leading to Inflation:

- Overheated Economy Scenario: If the economy is already doing well and operating at full capacity, printing more money can lead to inflation.

- Action Taken: If a central bank injects more money into an already booming economy, it can create too much demand for the same pool of available goods and services.

- Result: Since the production capacity is already maxed out, this excess demand increases prices, as businesses can't keep up with the demand.

- Inflation Outcome: The result is inflation, where the general price level rises because there's too much money chasing too few goods.

It's also important to note that inflation isn't necessarily mismanagement by a central bank; it's an additional tool of taxation - hidden in plain sight - as raising taxes requires a change in law and is politically unpopular in the eyes of the public.

To summarize, the central bank's management of the money supply is a powerful tool in influencing economic activity. The key is to understand the current state of the economy and adjust the money supply accordingly to either stimulate growth or prevent overheating, thereby controlling inflation.

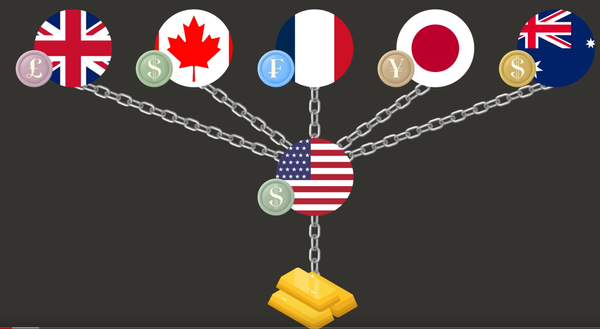

While centralized banking brought more systematic control over the money supply, it did not eliminate the risks of inflation and currency debasement. These challenges remain unsolved.

The Role of Taxes in a Central Banking System

At this juncture, a pertinent question arises: Why does the government require its citizens to pay taxes if the central bank can simply print more money? The answer lies in the fundamental economic roles that taxes and money printing serve.

Taxes as an Economic Tool:

- Controlling Money Supply: While printing money introduces new funds into the economy, taxes effectively withdraw money from circulation. This withdrawal is crucial for managing the overall money supply and controlling inflation.

- Forcing Currency Utilization: Taxes also compel citizens and businesses to use the local currency. By requiring taxes to be paid in the national currency, the government ensures a consistent demand for and use of the currency, which is essential for maintaining its value and stability.

1668 - Path to Nationalization

The government provided a more stable foundation for the bank's operations by nationalizing Sveriges Riksbank. However, this also meant that the bank's policies became closely aligned with the government's fiscal and monetary strategies, coupling the bank's role more deeply into the national economic framework.

Starting with Sveriges Riksbank, the central banks developed more sophisticated tools and policies to manage inflation and currency value over time. These include monetary policy mechanisms, reserve requirements, and interest rate adjustments.

1689 - Absolute monarchy takes power over the bank

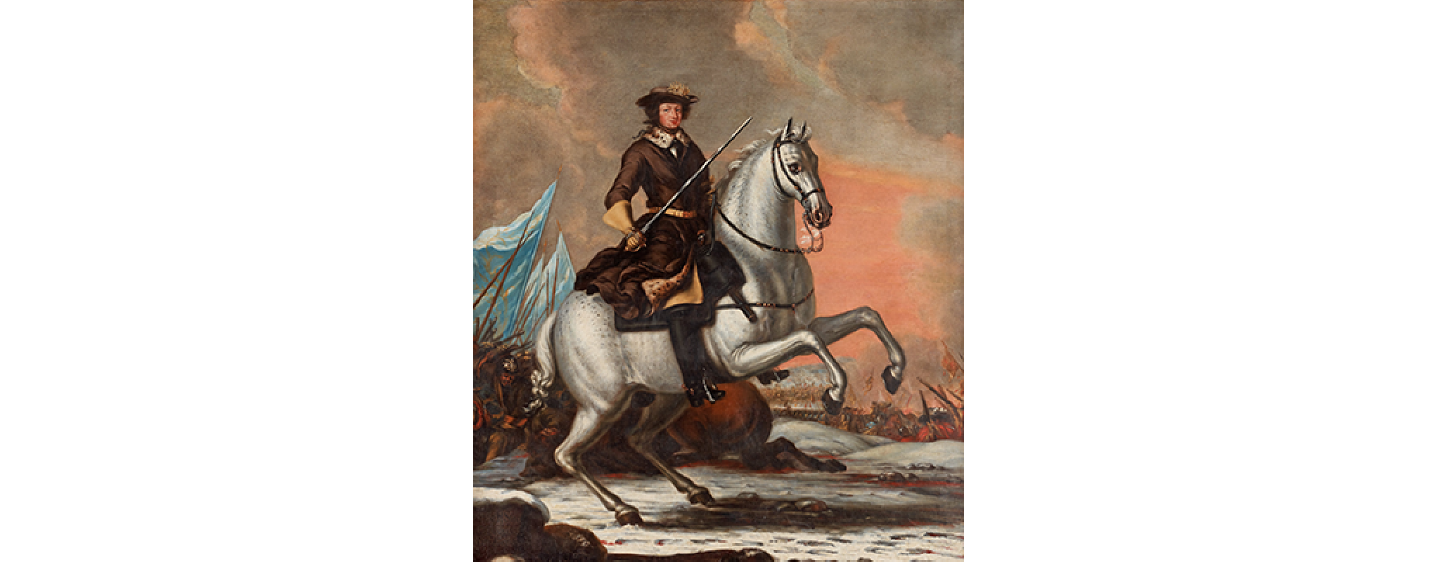

Charles XI introduced absolute monarchy and decided that the royal powers would have the last word on all matters. This also applied to the Bank of the Estates of the Realm (Sveriges Riksbank).

When the Bank of the Estates of the Realm (Sveriges Riksbank) was founded in 1668, the estates decided that the royal powers should not be involved. But Charles XI also wished to control the bank and even renamed it so that, for a time, it was known as His Royal Majesty’s State Bank.

What will be the next era after Central Banking?

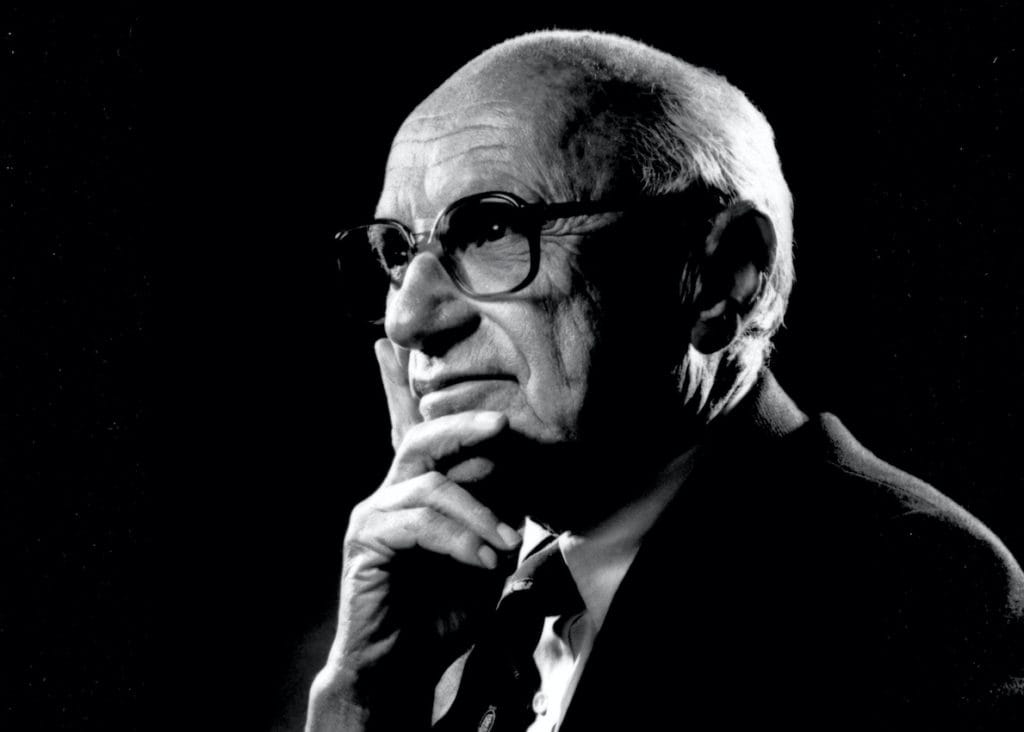

I will finish this blog post with an excerpt from the book, Capitalism and Freedom, by my favourite US economist of the 20th century, Milton Friedman.

Rules Instead of Authorities

How can we establish a monetary system that is stable and at the same time free from irresponsible government tinkering, a system that will provide the necessary monetary framework for a free enterprise economy yet be incapable of being used as a source of power to threaten economic and political freedom?

Government of law, instead of government of men - to protect monetary policy from day-to-day political whim of political authorities.

The law Friedman suggests is from his work: “A Program for Monetary Stability, op. cit. pp. 77-99”. Rule instructing the monetary authority to achieve a specific rate of growth in the stock of money. For this purpose, I would define the stack of money as including currency outside commercial banks plus all deposits of commercial banks. I would specify that central banks shall see to it that the total stock of money rises at annual rate between 3-5%.

Friedman died in 2006, and I don't want even to entertain the idea that my thinking can match or predict what would this Jewish economic mastermind and gentleman think about cryptocurrencies. Still, I will append to his paragraphs one more sentence in my Slavic, sarcastic, technical voice:

If only we had a mathematically secure, programmable, politically-censorship-resistant protocol for issuing new money at a transparent and fixed rate, let's say in regular blocks of time...